How to Shop for Christmas Gifts Without Breaking the Bank

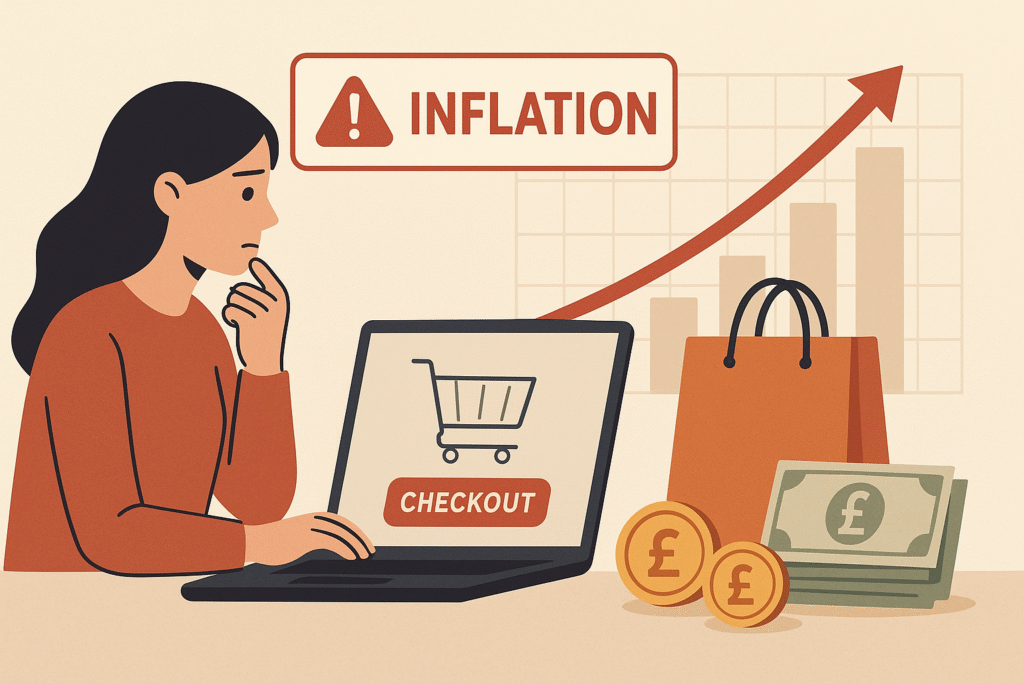

The Costly Festive Season

Christmas is meant to be a joyful time, but for many UK households, it comes with financial stress. According to recent studies, the average UK adult spends over £500 each festive season on gifts alone, not including extra costs like decorations, food, and entertainment. With the ongoing cost of living crisis, this amount can be overwhelming, especially for families and individuals trying to stick to a budget.

Overspending can lead to unnecessary debt, post-holiday financial strain, and even anxiety around money. But with a bit of planning, research, and the right tools, you can shop for gifts without breaking the bank — and still make Christmas magical for your loved ones.

Step 1: Set a Realistic Budget

The first step to financially stress-free Christmas shopping is to set a clear, realistic budget. Consider:

How much you can comfortably spend without affecting essentials like bills, groceries, or debt repayments.

Allocate amounts per person – it’s easier to manage spending when each gift has a cap.

Include extra festive costs – decorations, travel, food, and any parties.

For example, if your budget is £400 for gifts and you have 8 people to buy for, you can assign £50 per person. Having limits keeps you from impulse buys and ensures you don’t overspend.

Step 2: Make a Gift List Early

Impulse buying often comes from last-minute shopping. Making a detailed gift list early can prevent overspending.

Write down the people you want to buy for and potential gift ideas.

Prioritize gifts that are meaningful, useful, or experiential rather than expensive.

Stick to the list — browsing online or in stores without a plan often leads to unnecessary purchases.

A concrete gift list also helps you spot duplicate ideas or unnecessary items that can be removed before spending a single penny.

Step 3: Take Advantage of Deals Strategically

Sales events like Black Friday, Cyber Monday, and December discounts can be tempting. While deals can help you save, it’s easy to overspend on items you don’t need.

Tips for strategic deal shopping:

Pre-plan your purchases – Know what you need and stick to your list.

Set alerts for price drops – Use apps or browser tools to track discounts on items from your list.

Check multiple retailers – Compare prices to avoid paying more than necessary.

Ignore “scarcity” messages – Don’t rush to buy just because a deal says “limited stock.”

Remember, a “good deal” is only good if it’s something you were already planning to buy.

Step 4: Consider Alternative Gifts

Not all gifts need to be bought from high-street shops or big online retailers. Creative alternatives can save money and feel more personal:

Handmade gifts – Knit a scarf, bake treats, or craft something unique.

Experiences – Tickets to events, subscriptions, or cooking classes can be thoughtful and budget-friendly.

DIY gift hampers – Curate a collection of small items like chocolates, teas, or skincare samples.

Second-hand treasures – Vintage stores, charity shops, or online marketplaces often have hidden gems at low prices.

Alternative gifts not only save money but can be more meaningful and memorable than expensive gadgets or toys.

Step 5: Use Tools to Avoid Impulse Spending

Impulse purchases often happen online, especially when browsing for gifts. Small interventions can help:

Price comparison websites – Check if the item is cheaper elsewhere.

Cashback apps – Earn a little back on purchases you need to make.

Desktop tools – Extensions like Don’t Buy That® gently remind you to pause before checking out, helping to prevent spontaneous buys that blow your budget.

By creating a small delay before completing purchases, you’ll be more likely to stick to your plan and avoid overspending on unnecessary gifts or extras.

Step 6: Shop Early and Spread Out Spending

Waiting until December to shop can be financially risky, as you may end up buying whatever’s left or succumbing to last-minute deals.

Start shopping as early as October or November.

Spread out purchases across several weeks to reduce the impact on your monthly budget.

Take advantage of monthly sales or discounts without having to spend everything in one go.

Early shopping also reduces stress, prevents last-minute delivery issues, and gives you time to research gifts and compare prices.

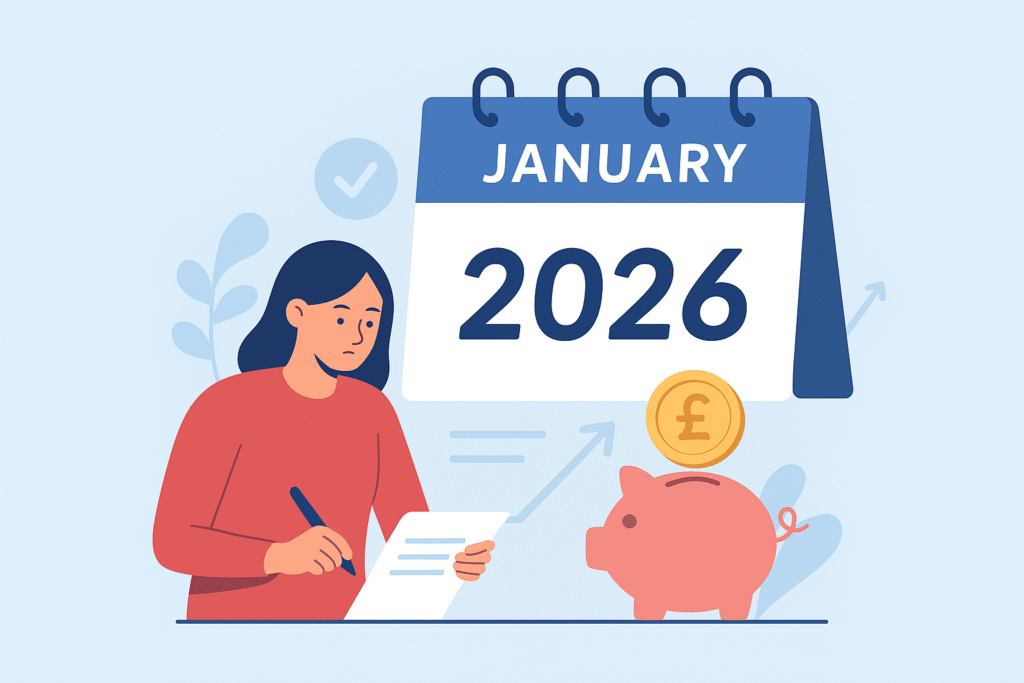

Step 7: Set Up a Savings Jar or Christmas Fund

Planning ahead for Christmas expenses is easier if you start saving in advance.

Open a separate account, envelope, or jar for Christmas money.

Deposit a small amount weekly — even £10/week adds up to over £400 by December.

Avoid dipping into essential funds or emergency savings.

By treating Christmas spending like a pre-planned expense, you reduce the need to use credit cards or go into debt.

Step 8: Be Mindful of Packaging and Wrapping Costs

Gift wrap, boxes, and bags can add up — sometimes costing £1–£3 per item, which quickly multiplies for large families.

Use recycled paper, reusable gift bags, or DIY wrapping.

Buy supplies in bulk during sales to reduce per-item cost.

Creative presentation can make gifts feel luxurious without overspending.

Step 9: Avoid Comparison Traps on Social Media

Scrolling through Instagram or TikTok can make you feel like you need to buy the same trendy gifts everyone else is getting.

Focus on meaningful gifts rather than trendy items.

Remember, online images are curated and often overstate the “must-have” factor.

Stick to your list and budget — trends come and go, but thoughtful gifts last.

Step 10: Review and Adjust Before Checkout

Before clicking “buy,” take a moment to review:

Is this gift on your list?

Does it fit your budget?

Could a cheaper, equally thoughtful alternative work?

Am I buying this because of an emotional impulse?

This simple pause, even 10–15 seconds, can save hundreds of pounds over the festive season.

Real-Life Example: How Pausing Saved Money

Sophie, a 32-year-old in Manchester, usually spent £600 on Christmas gifts, often going over budget. This year:

She made a list and allocated £50 per person.

She used a small browser pause tool to avoid last-minute impulse buys online.

She opted for 3 DIY gifts and 1 experience-based gift per family member.

By following these steps, Sophie spent £380, saved over £200, and felt far less stressed about finances.

Bonus Tips: Small Ways to Maximise Savings

Use reward points and loyalty schemes – Retailers like Boots, Tesco, or Amazon often allow gift purchases with points.

Group gifts for families – One shared gift can be more impactful and cost-effective.

DIY experience vouchers – Free activities, movie nights, or cooking classes can replace costly gifts.

Even small tweaks to your shopping habits can significantly reduce holiday stress and spending.

Enjoy Christmas Without Financial Stress

Christmas should be joyful, not financially draining. By planning ahead, budgeting, using tools to pause spending, and considering creative gifts, you can shop responsibly and make the holiday special for everyone.

Before you hit “checkout” on any online gift, give yourself a moment to pause. Tools like Don’t Buy That® can help you stop impulse spending, stick to your budget, and save hundreds of pounds this festive season. Take control of your Christmas shopping today — plan, pause, and shop smarter!