Stop Mindless Spending: Small Habits That Make a Big Difference in the 2026 UK Cost‑of‑Living Crisis

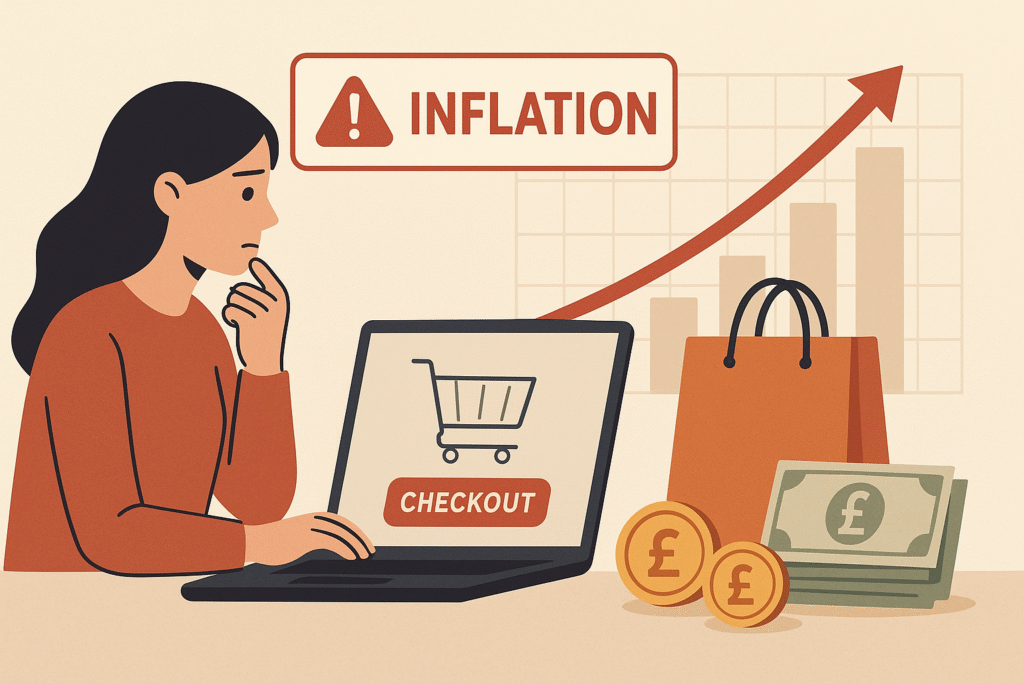

The 2026 Squeeze Is Real

The cost‑of‑living crisis isn’t just a phrase — it’s a daily reality for millions of UK households. Inflation recently jumped to 3.5%, driven by rising energy, water, and council tax bills. The Guardian Energy debt remains alarmingly high, with billions owed across the UK. ConsumerScotland Meanwhile, food prices are predicted to stay elevated “well into 2026,” putting further strain on household budgets. Yahoo Finance+1

At the same time, many of us are still making impulse purchases, often without realising it. Those “little treats” — that click-happy “buy now” on Amazon, the small online gadget, or the extra takeaway — quietly drain our wallets. But in a tight economic climate, these micro-spends matter more than ever.

Thankfully, you don’t need to overhaul your entire life to start saving. Small, consistent habits can make a huge difference.

Why Mindless Spending Spikes During a Crisis

1. Psychological Relief Under Stress

Money anxiety makes us prone to emotional spending. When bills rise and wages stretch thin, shopping can feel like a quick escape — a way to grab a little control or a tiny dopamine hit.

2. Frictionless Online Shopping

With one-click checkout, saved card details, and targeted ads, online spending is ridiculously easy. Retailers design their sites to push you to buy now — not think later.

3. Persistent Price Pressures

Inflation isn’t just high — costs are shifting in all the places that matter most: energy, food, and housing. Office for National Statistics+1 The average household weekly spend hit £623.30 recently, including big jumps in fuel, power, and transport. Office for National Statistics When essential costs gobble up more of your income, the margin for “luxury” impulse buys shrinks — but the temptation doesn’t.

10 Simple Habits to Curb Mindless Spending

Here are practical, UK‑relevant habits you can build now to stop impulse buys, save smarter, and protect your budget in 2026.

1. Insert a Pause Before Checkout

Take 10–20 seconds to think before confirming any non-essential online purchase.

Use a desktop extension like Don’t Buy That® to introduce a gentle delay before the checkout button activates. That small pause often kills the impulse.

2. Remove Saved Payment Details

Avoid letting websites store your card details.

Manually entering them adds friction — making you more likely to hesitate and reconsider.

3. Use a Wish List Instead of Buying on the Spot

Rather than buying items immediately, add them to a wishlist.

Revisit the list after 24–48 hours. Often, the urge to buy has passed.

4. Limit Marketing Exposure

Unsubscribe from retailer emails offering “flash deals” or “today only”.

Use ad blockers or browser settings to reduce retargeted ads.

The fewer prompts you get, the fewer impulse triggers you face.

5. Set a Weekly or Monthly “Fun Money” Budget

Allocate a small, fixed amount each month for non-essentials.

Treat it like a line item in your budget — not a free-for-all.

This gives you freedom, but with guardrails.

6. Automate Your Savings First

Set up a standing order to move money into a savings account or “holiday fund” as soon as you get paid.

Even just £10–£20 a week adds up, and you’re less tempted to spend money you never “see.”

7. Track Your Spending, Weekly

Use a budgeting app, spreadsheet, or notebook to record all spending (including the small buys).

Reviewing regularly helps you spot patterns: where your money slips through and where you have opportunities to cut back.

8. Swap Out Expensive Treats

Replace costly habits with cheaper alternatives: brew your own tea, swap your daily takeaway for a packed lunch, or walk instead of grabbing a ride.

These swaps won’t feel like deprivation — they become part of a more mindful routine.

9. Review Subscriptions Quarterly

Go through all your subscriptions (streaming, fitness, apps) at least every three months.

Cancel things you no longer use or value. This is low-hanging fruit for freeing up cash.

10. Build Gratitude and Reflect Before Buying

Ask yourself: Do I want this because I feel stressed, bored, or pressured? Or do I actually need or want it?

Try a quick mindfulness check: pause, breathe, and reflect. Your brain will often answer for you.

Putting It into Practice: A UK Household Example

Meet Jade and Ali, a couple renting in Birmingham:

In 2025, rising bills pushed them to examine their spending. Food and gas were taking a bigger chunk of their pay.

They decided to introduce a “spend pause” habit: before each non-essential purchase, they waited 15 seconds, asked themselves if they really needed it, and then made a decision.

They set up a £30 weekly “fun money” pot — enough to treat themselves, but not break their budget.

They removed saved card details from online stores and moved all recurring subscriptions to a spreadsheet.

As a result, by mid-2026, they had cut impulse spending by around 40%, freed up cash for savings, and felt more in control.

Why These Habits Matter Right Now

Inflation & Food Costs: With food inflation projected to stay at 5% or more, your grocery bill will be under pressure for some time. Yahoo Finance

Energy Bills: Despite some lowering predictions, energy remains a major cost. Many UK households are still struggling with energy debt. ConsumerScotland

Budget Uncertainty: Upcoming budget decisions could introduce more pressure. Household costs indices remain volatile. Office for National Statistics

Low-Income Pressure: Lower-income households are now facing similar or worse inflation rates than higher-income ones. Office for National Statistics

In this climate, small, consistent habits can be your financial defence.

How to Stick to These Habits

Start Small – Don’t try to do all 10 at once. Pick two or three that feel manageable.

Use Reminders – Sticky notes, phone alerts, or calendar cues can prompt you to pause or reflect.

Track Progress – Measure how much impulse spending is reduced and how much you save or reallocate.

Be Kind to Yourself – If you slip up, don’t beat yourself up. Just reset, reflect, and start again.

Get Accountability – Share goals with a partner or friend, or join an online community (like a money-saving forum) for support.

Take Small Steps, Make Big Impact

In 2026, you don’t need to wait for a windfall or a perfect budget to take control. By introducing small habits — pausing before you buy, tracking your spending, and automating your savings — you can drastically cut down on mindless spending and protect your money from the cost‑of‑living squeeze.

Ready to interrupt impulse spending? Try a simple tool like Don’t Buy That® on your desktop browser to help you pause and reflect before every online checkout. Small pauses, big savings — start now.