The Psychology of Online Shopping: Why You Click ‘Buy Now’

Without Thinking

The Digital Shopping Trap

Online shopping in the UK has grown massively in the last decade. In 2024 alone, over 80% of adults purchased goods online, from groceries to gadgets. While convenient, the digital shopping environment is designed to make purchases quick and automatic — often leading to impulse buying.

If you’ve ever clicked “buy now” and wondered why, you’re not alone. The combination of psychology, marketing tactics, and easy payment systems creates an environment where mindless spending thrives.

The Dopamine Effect: Why Buying Feels Good

Buying triggers a dopamine release, the brain’s “feel-good” chemical. This reward mechanism creates a short-term high — you feel happy for a moment after completing a purchase.

Dopamine reinforces behaviour, making it more likely you’ll repeat it.

The instant gratification of one-click checkout exploits this natural reward system.

Over time, your brain can form habit loops, where online shopping becomes an automatic response to stress, boredom, or even seeing a product you like.

Example: A shopper scrolling on Amazon sees a discounted gadget. The brain anticipates a reward. The checkout button is clicked within seconds — often without conscious decision-making.

Impulse Buying in the UK: The Numbers

Recent surveys highlight the impact of online impulse spending in the UK:

The average adult spends £200–£300 per month on unplanned purchases.

Over a year, that’s £2,400–£3,600, enough to cover several months of groceries or bills.

Categories most affected include fashion, gadgets, food delivery, and beauty products.

This demonstrates that understanding the psychology behind purchases isn’t just interesting — it’s financially important.

Marketing Tactics That Trigger Impulse Buying

Retailers know how to exploit human psychology. Some common tactics include:

1. Scarcity and Urgency

Phrases like “Only 3 left in stock!” or “Sale ends in 1 hour!” create pressure to act fast.

Scarcity triggers FOMO (Fear of Missing Out), compelling immediate purchases.

2. Social Proof

Reviews, ratings, and testimonials influence buying behaviour.

Seeing that “thousands of others bought this” increases perceived value and urgency.

3. Personalisation

Ads and product recommendations are tailored to your browsing history.

Personalisation tricks the brain into thinking the product was “made just for you,” increasing temptation.

4. Gamification

Reward points, loyalty programs, and spinning “discount wheels” make buying feel like a game.

This adds excitement and encourages repeated purchases.

Emotional Triggers Behind Online Spending

Impulse buying isn’t just marketing — it’s emotional. Common triggers include:

Stress: Shopping can provide a temporary mood lift.

Boredom: Many click “buy now” simply out of habit or to pass time.

Sadness or Anxiety: Small purchases create a brief feeling of control or happiness.

Understanding your emotional triggers is key to intercepting impulsive purchases before they happen.

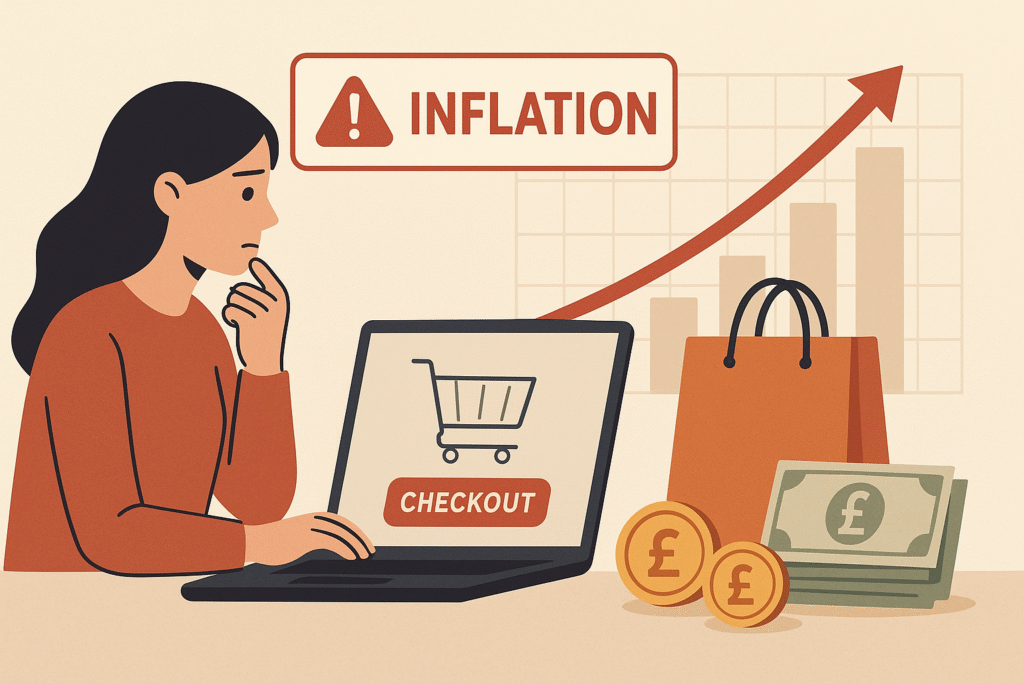

Why the Checkout Button Is So Powerful

The checkout button is the final hurdle — often the only moment that separates intention from action. Its design is critical:

Bright colours, large fonts, and placement near product descriptions encourage clicks.

One-click purchasing removes friction, making buying instantaneous.

Pausing even a few seconds before clicking can reduce impulse buys significantly.

This is where small interventions, like desktop tools, come in handy.

How to Pause and Regain Control

There are practical ways to slow down your online shopping habits:

1. Use a Pause Tool

Browser extensions like Don’t Buy That® insert a brief delay before checkout.

This friction allows your brain time to evaluate whether the purchase is necessary.

2. Set Spending Limits

Allocate a monthly budget for online purchases.

Track spending and enforce limits.

3. Create a Wishlist

Add items to a wishlist instead of buying immediately.

Revisit after 24–48 hours — many impulse purchases are forgotten.

4. Remove Saved Payment Details

Requiring a manual entry of card details adds friction, making it less automatic to spend.

5. Recognise Emotional Triggers

Note when you’re shopping due to stress, boredom, or sadness.

Seek alternatives, like a walk, a call to a friend, or a hobby.

Real-Life Example: How a Pause Saves Money

Consider Jack, a 35-year-old in London:

Pre-intervention, Jack spent £250/month on gadgets and fashion online.

He installed a browser extension that added a 10-second pause at checkout and reminded him to reconsider.

Within six months, impulse spending dropped by 60%, saving over £1,500, without reducing planned purchases.

Small pauses like this can be surprisingly effective because they interrupt automatic behaviour.

Tips for Mindful Online Shopping

Make a List Before You Browse – Treat online shopping like a mission, not a leisure activity.

Limit Notifications – Disable push notifications from shopping apps to reduce temptation.

Check Your Spending Weekly – Awareness prevents mindless accumulation of small purchases.

Set Goals – Decide what your money could be used for instead, e.g., saving for a trip, paying off debt.

By combining these strategies, you can enjoy online shopping without harming your finances.

Seasonal & Event Considerations

Sales periods like Black Friday, Christmas, and New Year amplify impulse spending:

Flash sales and “limited-time deals” create urgency.

Social media ads bombard you with trendy items.

Pre-planning, pausing before purchases, and sticking to a list are essential.

Even small interventions during these high-pressure periods can prevent hundreds of pounds of overspending.

Take Control Before You Click “Buy Now”

Online shopping can feel effortless, but the psychology behind it is designed to encourage spending. By understanding triggers, using small pauses, and implementing mindful habits, UK shoppers can regain control, save money, and reduce financial stress.

This holiday season, don’t let impulse buys sabotage your budget. Take a moment before every online purchase — tools like Don’t Buy That® can help you pause, rethink, and shop smarter. Your wallet (and your future self) will thank you.