What Is Impulse Spending Costing You?

A Look at the £1,000 Habit

We all make the occasional unplanned purchase — a new gadget, a skincare item you saw on TikTok, or another gym top “because it was on sale.” But for many UK shoppers, these quick clicks can quietly add up to over £1,000 a year in impulse spending.

So what exactly are we spending that money on — and how can we stop?

The UK Impulse Spending Breakdown

According to recent surveys, the average Brit spends between £80–£100 per month on things they didn’t plan to buy. That adds up to £960–£1,200 annually.

🔍 Common impulse purchases:

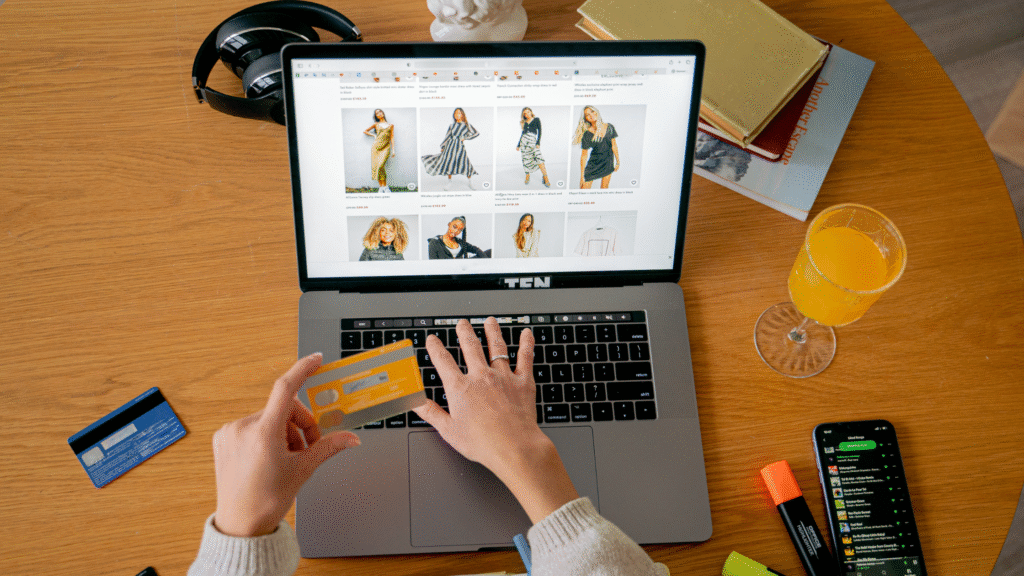

Fashion & fast fashion

Beauty & skincare products

Tech gadgets

Home decor & small appliances

Takeaway meals or food delivery apps

Why Do We Impulse Shop?

Retailers are experts at triggering our spending habits:

Flash sales & time-limited deals

Free shipping thresholds

1-click checkouts

“People also bought” sections

Social media ads & influencer content

Combine this with boredom, stress, or late-night browsing — and your wallet doesn’t stand a chance.

Real Cost vs. Emotional Cost

You’re not just spending money — you’re also buying clutter, guilt, and regret.

📌 True cost example: That £25 impulse skincare haul =

2 meals out

1 week’s worth of groceries

A month of streaming subscriptions

The Fix: Small Friction That Changes Everything

That’s where the Don’t Buy That browser extension comes in. It:

Detects when you’re shopping on major UK sites

Gently prompts you to pause with a visual popup

Delays checkout or “Buy Now” buttons by a few seconds

💡 That brief pause helps disrupt the automatic behaviour of impulse buying.

Think of It Like Saving £1,000 a Year

Every time you avoid an unnecessary purchase, you’re effectively putting money back in your pocket. Use that money for:

Savings goals

Travel or holidays

Paying off debt

Treats you actually value

Start Saving Today

Download Don’t Buy That — it’s free, private, and built for UK shoppers who want to be more mindful with their money.

🎯 One click can save you hundreds.