How the Upcoming UK Budget Could Affect Your Wallet

Financial Pressure in the UK

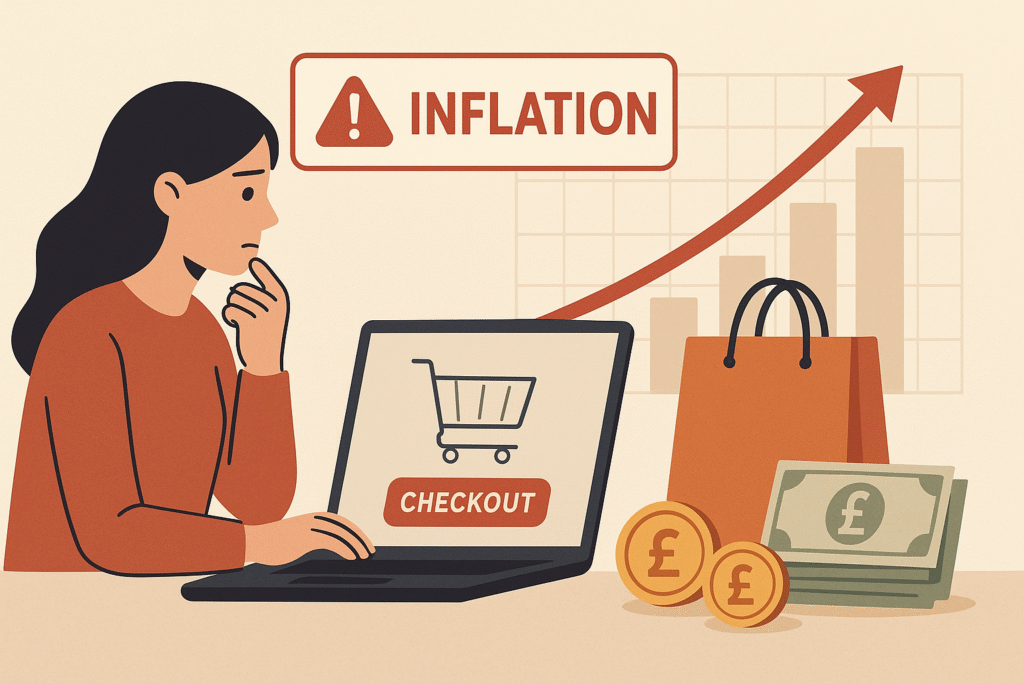

The UK is facing a period of financial strain. Rising energy bills, increasing grocery costs, and inflation have already stretched household budgets thin. Now, with the upcoming 2025 UK budget, many working people fear additional taxes or changes to benefits that could further reduce their take-home pay.

According to recent reports, average household inflation has reached over 10% for essentials like food and energy. At the same time, wage growth has struggled to keep pace, leaving many families with little disposable income. In this environment, controlling spending and avoiding impulse purchases is more important than ever.

Even small savings can make a significant difference when budgets are tight. By combining practical strategies with digital tools, you can protect your finances from unnecessary strain.

Potential Changes in the 2025 UK Budget

While the exact details of the budget are not yet final, analysts have suggested several areas where working households might see a financial impact:

1. Higher Income Taxes

There’s speculation that the basic or higher-rate income tax thresholds could be adjusted. Even a small increase could mean hundreds of pounds less in annual take-home pay for middle-income earners. For example, if someone earning £30,000 a year faces an extra 1% tax, that’s around £300 less in disposable income annually.

2. National Insurance Contributions

National Insurance may also rise, affecting both employees and self-employed individuals. Increased contributions reduce the money you have available each month, meaning that every pound you save on discretionary spending counts even more.

3. Changes to Benefits or Tax Credits

Some benefits could be reduced or means-tested further. Families relying on support for childcare, housing, or energy bills may find their budgets even tighter. Even small reductions — £20–£30 per week — can accumulate to over £1,000 per year, making careful spending essential.

4. Indirect Costs from Inflation and Policy Changes

Beyond taxes, the budget can affect energy, fuel, and food prices. New levies or cuts to subsidies could increase household bills. Combined with rising inflation, this creates a perfect storm for overspending if careful budgeting isn’t practiced.

Why Controlling Spending Is Critical Now

During uncertain economic times, impulse purchases can quietly drain finances. Things like unnecessary subscription renewals, daily takeaway coffees, or small online “treats” can add up to hundreds per month.

Examples of Typical UK Household Overspending

Daily takeaway coffee (£3/day) → £90/month

Small impulse buys online (£5/day) → £150/month

Unplanned subscription services (£10/month each) → £120/year per service

For households already under pressure, cutting even some of these small expenses can make the difference between meeting bills or falling behind.

Tips to Reduce Impulse Spending

Here are practical strategies to keep your finances in check as the new budget approaches:

Track Every Pound Spent

Use apps or spreadsheets to log daily expenses. Seeing where money goes highlights areas where spending can be reduced.Set a Strict Budget

Prioritise essentials: rent/mortgage, bills, groceries. Only allocate money for non-essentials after essentials are covered.Delay Non-Essential Purchases

Implement a 24-hour or 48-hour rule. Many impulses fade after a short pause.Plan Seasonal Shopping Carefully

Black Friday, Christmas, and New Year sales are tempting, but sticking to a pre-made list prevents overspending.Leverage Cashback and Comparison Tools

Even necessary purchases can be optimised. Compare prices online or use cashback platforms to save additional pounds.Pause Online Purchases

Desktop tools like a browser extension that pauses checkout can disrupt mindless spending and give you time to reconsider purchases.

Real-Life Scenario: The Budget’s Impact on a Typical Household

Consider a family of four in Manchester earning £35,000 combined. If the budget increases income tax and National Insurance by even 1–2%, their disposable income might fall by £500–£700 per year. Combined with rising energy and grocery costs, this family could be forced to cut discretionary spending by 10–15% just to maintain their standard of living.

By using spending tools and implementing budgeting strategies, that family could:

Avoid £150/month in impulse spending online

Save £50/month by cancelling unused subscriptions

Reduce seasonal overspending by planning gifts and meals

In total, these strategies could free up £2,400 annually, offsetting much of the budget impact and providing peace of mind.

Seasonal Shopping and the Budget

Black Friday, Christmas, and New Year sales are especially risky when budgets are tight. Many shoppers overspend on “deals” they don’t need.

Black Friday & Cyber Monday: Flash sales encourage panic buying.

Christmas: Emotional spending spikes during gift-giving.

New Year: Post-holiday deals tempt buyers after already high spending.

Planning purchases, setting strict limits, and pausing before checkout can help prevent regretful spending.

Practical Steps to Stay Ahead

Review Bills and Subscriptions – Cancel unused services and renegotiate where possible.

Cook at Home More – Simple meal planning reduces takeaway costs.

Use Shopping Lists – Stick to essentials in-store or online.

Apply the Pause – Before any non-essential purchase, give yourself 24–48 hours to reconsider.

Even small adjustments can make a significant difference when tax or cost-of-living pressures increase.

Conclusion: Take Control Before the Budget Hits

The upcoming UK budget may raise taxes and place additional pressure on working households. By proactively controlling spending, avoiding impulse purchases, and planning seasonal shopping, you can protect your finances and build a safety net.

Start saving smarter today: Install a free desktop browser extension (Chrome, Edge, or Firefox) to pause before every purchase and make mindful spending decisions.